What Licenses Are Needed to Start a Cleaning Business in 2026 (Complete US Guide)

July 26, 2025 - 17 min read

July 26, 2025 - 17 min read

Table of Contents

| TL;DR Starting a cleaning business in the US requires a general business license, DBA registration, EIN, and potentially sales tax permits. Most states also expect you to carry liability insurance and a janitorial surety bond before cleaning homes or offices professionally. Managing all these requirements becomes easier with the right field service management software that keeps your business organized from day one. |

Starting a cleaning business in 2026? Before you take on your first client, you’ll need the right licenses, bonds, and insurance to operate legally.

Every US state requires some form of business registration—and operating without proper licensing exposes you to fines, lawsuits, and denied insurance claims. The good news? Most cleaning business owners complete the licensing process in just 1-2 weeks.

This guide covers exactly which licenses you need, how much they cost, and the step-by-step process to get fully licensed, bonded, and insured. Plus, how the right field service management software simplifies everything from day one.

KEY HIGHLIGHTS

Cleaning Business Licenses to Check in 2026

Yes, you need a cleaning business license to operate legally in the United States. While there’s no federal cleaning license, every state requires business owners to register and obtain local permits before accepting payment for services. Operating without proper licensing exposes you to fines, lawsuits, and denied insurance claims – even if you’re just starting with a few residential clients.

Compliance experts consistently frame licensing as a credibility signal that shows clients you run a legitimate, professional operation – not just a side hustle. This matters when you’re entering clients’ homes or handling sensitive workplace environments.

Key Takeaway: A general business license is the baseline requirement before you start cleaning homes or offices for pay. Without it, you’re technically operating illegally and risking your entire business.

The consequences of running an unlicensed cleaning business can be severe:

| Consequence | Details |

|---|---|

| Fines | $500-$10,000+ depending on state and violation severity |

| Business suspension | Forced to stop operations until licensed |

| Denied insurance claims | Insurance companies can refuse to pay claims |

| Legal liability | Personal assets at risk in lawsuits |

| Lost contracts | Commercial clients require proof of licensing |

| Criminal charges | Some states treat repeat violations as misdemeanors |

Pro Tip: The good news? Getting licensed is straightforward and relatively inexpensive. Most cleaning business owners can complete the process in 1-2 weeks.

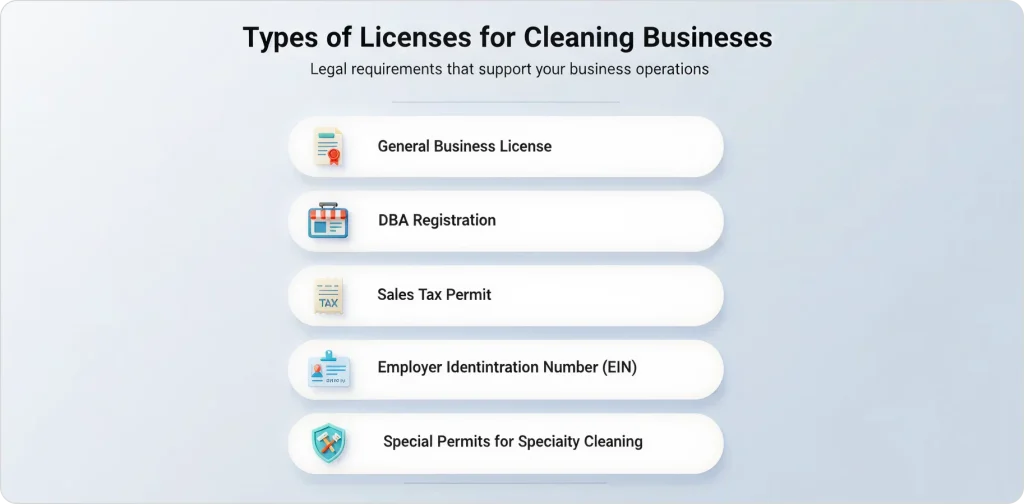

Understanding which licenses you need prevents costly delays and compliance issues. Here’s a breakdown of the essential permits for US cleaning businesses:

A general business license is your permission slip to operate a business in your city or county. Nearly every municipality in the US requires one.

How to get it:

Pro Tip: Some cities require a separate license for each location where you operate. If you serve multiple cities, check each municipality’s requirements.

If you operate under any name other than your legal name, you need a DBA registration. For example, if your legal name is “Jane Smith” but you operate as “Sparkle Clean Services,” you need a DBA.

DBA requirements:

In states where cleaning services are taxable, you’ll need a sales tax permit to collect and remit taxes.

States Where Cleaning Services Are Taxable:

| State | Tax Rate |

|---|---|

| Texas | 6.25% + local |

| New York | 4% + local |

| Florida | 6% + local |

| Ohio | 5.75% + local |

| New Mexico | 5.125% + local |

| Hawaii | 4% + local |

Note: Tax laws change frequently. Check with your state’s Department of Revenue for current requirements.

An EIN is your business’s tax ID number from the IRS. You’ll need it for:

How to get an EIN:

Key Takeaway: Get your EIN before opening a business bank account. It’s free and takes about 10 minutes online.

Some states require a vendor’s license if you’re selling products along with services (like cleaning supplies to clients). Check with your state’s Department of Revenue to determine if this applies to your business model.

Certain types of cleaning require additional certifications:

| Specialty Type | Required Certifications |

|---|---|

| Medical/Healthcare facilities | OSHA bloodborne pathogen training, healthcare cleaning certification |

| Hazardous materials | EPA certifications, HAZWOPER training |

| Crime scene/biohazard | Bloodborne pathogen certification, state-specific permits |

| Construction cleanup | May require contractor’s license in some states |

| High-rise window cleaning | Fall protection certification, sometimes specific permits |

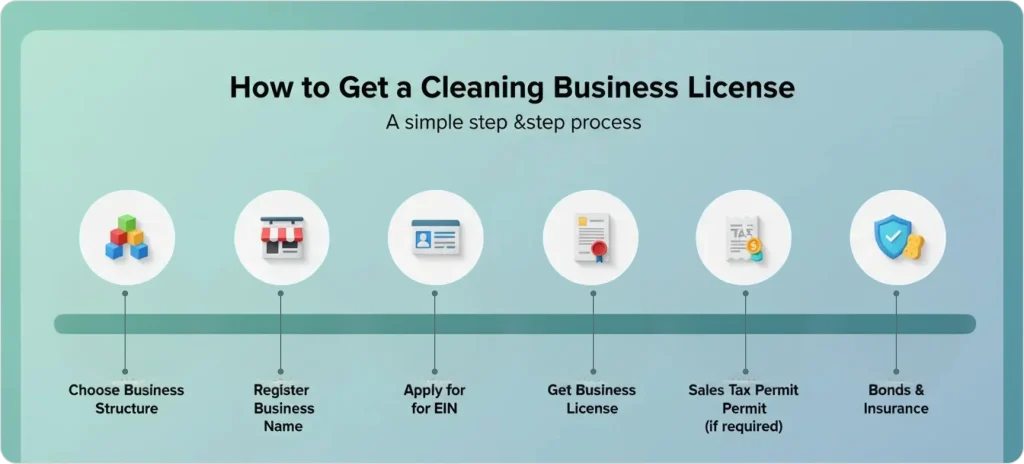

Getting your cleaning business properly licensed involves multiple agencies. Here’s the complete process:

Before applying for licenses, decide how you’ll structure your business:

| Structure | Pros | Cons | Best For |

|---|---|---|---|

| Sole Proprietorship | Simple, low cost | Personal liability | Solo cleaners starting out |

| LLC | Liability protection, flexible | More paperwork, fees | Growing cleaning businesses |

| S-Corp | Tax benefits, credibility | Complex, expensive | Established operations |

| Partnership | Shared responsibility | Shared liability | Multiple owners |

Pro Tip: Most cleaning business owners choose an LLC for the balance of liability protection and simplicity. Formation costs $50-$500 depending on your state.

Once licensed, you’ll need efficient systems to manage your operations. Learn more about how to start a cleaning business with our comprehensive guide.

Ready to Streamline Your Cleaning Business?

Once you’re licensed, you’ll need a system to manage clients, schedule jobs, and send invoices. FieldCamp’s AI-powered scheduling software handles it all – from automated dispatch to route optimization.

DOWNLOADABLE CHECKLIST

Complete Licensing Checklist for Cleaning Businesses

☐ Choose business structure (LLC recommended)

☐ Search and register business name

☐ File DBA registration if needed

☐ Apply for EIN (free at IRS.gov)

☐ Get general business license from city/county

☐ Apply for sales tax permit if required

☐ Purchase general liability insurance

☐ Obtain janitorial surety bond

☐ Get workers’ compensation (before hiring)

☐ Set up business bank account

☐ Create client contracts with licensing info

Bonds add another layer of protection for your clients and help you win more business. Here’s what you need to know:

A janitorial surety bond protects your clients if an employee steals from them or causes intentional damage. Unlike insurance (which protects you), bonds protect your clients.

How janitorial bonds work:

Typical bond amounts:

| Operation Size | Bond Amount |

|---|---|

| Small residential operations | $5,000-$10,000 |

| Commercial cleaning | $10,000-$25,000 |

| Large operations | $25,000-$100,000+ |

Cost: 1-5% of bond amount annually (a $10,000 bond costs roughly $100-$500/year)

Some cities require a license bond before issuing your business license. This guarantees you’ll follow local regulations and pay applicable fees.

Requirements vary by location:

Pro Tip: When clients ask if you’re “bonded,” they usually mean janitorial bonding. Having this coverage signals professionalism and builds trust immediately.

Insurance and bonding work together to protect your cleaning business. Here’s what coverage you need:

General liability protects you when:

Typical coverage:

Required in most states once you hire employees. Some states require coverage for even one employee.

| State | Requirement |

|---|---|

| California | 1+ employees |

| Texas | Optional (but recommended) |

| Florida | 4+ employees (non-construction) |

| New York | 1+ employees |

| Illinois | 1+ employees |

Cost: Varies by state and risk classification – cleaning typically runs $0.50-$2.00 per $100 of payroll.

If you use vehicles for your cleaning business, your personal auto insurance won’t cover business use.

Coverage needed:

Consider this coverage if you:

Cost: $200-$500/year for basic coverage

| If this describes you… | You need… |

|---|---|

| Solo cleaner, residential only | General liability + bond |

| 1-3 employees, residential | Above + workers’ comp |

| Commercial clients | Above + $1M+ liability limits |

| Multiple vehicles | Above + commercial auto |

| Medical facility cleaning | Above + professional liability |

Requirements vary significantly across states. Here’s what you need to know for the most-searched states:

| State | Business License | Sales Tax on Cleaning | Workers’ Comp Threshold |

|---|---|---|---|

| California | City/County | Yes | 1 employee |

| Texas | City level | Yes (6.25%+) | Optional |

| Florida | County level | Yes | 4 employees |

| New York | Municipal | Yes | 1 employee |

| Illinois | State + local | Varies by service type | 1 employee |

| Ohio | City level | Yes (5.75%+) | 1 employee |

| Pennsylvania | Local | No (most services) | 1 employee |

| Michigan | Local | No | 1 employee |

| Arizona | State + local | No | 1 employee |

| Massachusetts | Local | No | 1 employee |

Warning: Tax laws and licensing requirements change frequently. Always verify current requirements with your state’s official resources before starting your business.

Budget for these licensing and startup costs when planning your cleaning business:

| Item | Cost | Frequency |

|---|---|---|

| General business license | $50-$400 | Annual |

| LLC formation | $50-$500 | One-time |

| DBA registration | $10-$100 | One-time/renewal varies |

| EIN | FREE | One-time |

| Sales tax permit | FREE-$50 | One-time |

| Janitorial bond | $100-$500 | Annual |

| General liability insurance | $300-$600 | Annual |

| Workers’ comp | $500-$2,000+ | Annual |

| Business Type | Estimated Cost |

|---|---|

| Solo, residential only | $500-$1,200 |

| 1-3 employees | $1,500-$3,000 |

| Commercial focus | $2,500-$5,000 |

Pro Tip: Don’t let licensing costs discourage you. These are legitimate business expenses that build credibility and protect your investment. Many successful cleaning businesses started with minimal upfront investment and grew rapidly by doing things right from the start.

Use our free cleaning cost calculator to help determine your pricing strategy that covers these costs.

Learn from others’ mistakes to save time, money, and headaches:

Many cleaning business owners start taking clients before completing their licensing. This exposes you to fines and makes it harder to get insurance coverage if something goes wrong.

Fix: Complete all licensing before accepting your first paying client.

Getting licensed isn’t a one-time task. Most licenses require annual renewal. Missing renewal deadlines can result in penalties or forced business closure.

Fix: Set calendar reminders 30-60 days before each renewal deadline. Better yet, use field service software with automated reminders to stay on track.

Many owners assume state licensing is all they need. In reality, cities and counties often have additional requirements.

Fix: Contact your local city and county clerk’s offices directly.

While not legally required everywhere, operating without a janitorial bond limits your client base. Many homeowners and most commercial clients require bonded cleaners.

Fix: Get bonded early – it’s inexpensive and opens more opportunities.

Minimum coverage might seem cheaper, but it leaves you exposed. One major claim can exceed your limits and threaten your personal assets.

Fix: Consult with an insurance agent who specializes in service businesses. Get adequate coverage from the start.

Operating without a business bank account makes tax time complicated and reduces your liability protection.

Fix: Open a dedicated business bank account immediately after getting your EIN.

Take Your Cleaning Business to the Next Level

You’ve got the licensing figured out. Now it’s time to run your business like a pro. FieldCamp handles AI-powered dispatching, smart route optimization, client management, and invoicing – so you can focus on growth.

Starting a cleaning business license process in the US requires attention to detail but isn’t complicated. You’ll need a general business license from your city or county, an EIN from the IRS (free), DBA registration if using a trade name, and potentially a sales tax permit depending on your state. Adding a janitorial bond and general liability insurance completes your “licensed, bonded, and insured” credentials that clients expect.

The key is doing things right from the start. Research your specific state and city requirements, budget for licensing costs, and set up renewal reminders so you stay in good standing. Most successful cleaning businesses complete their licensing within 1-2 weeks and spend $500-$1,500 on initial setup.

Once you’re properly licensed, the next challenge is managing your growing business efficiently. That’s where the right tools make all the difference – from scheduling and route optimization to client management and invoicing.

Ready to learn more? Check out our guides on how to charge for cleaning services and how to get clients for your cleaning business.

Ready to Run Your Cleaning Business Like a Pro?

From automated scheduling to instant invoicing, FieldCamp gives you everything you need to manage and grow your cleaning business. Join thousands of field service pros who’ve made the switch to AI-powered field service automation.

Technically, no. While there’s no federal cleaning license, every US state requires some form of business registration before you can legally accept payment. Operating without proper licensing exposes you to fines, lawsuits, and denied insurance claims. Most residential and all commercial clients also require proof of licensing before hiring you. Learn more in our guide on how to start a cleaning business.

A general business license typically costs $50-$400 annually, depending on your location. Total first-year licensing costs (including LLC formation, bonds, and insurance) range from $500-$1,200 for solo operators to $2,500-$5,000 for commercial cleaning businesses with employees. The EIN from the IRS is free.

Licensed means you have proper business registration with your city, county, and state. Bonded means you carry a janitorial surety bond that protects clients if your employees steal or cause intentional damage. Insured means you have general liability coverage that pays for accidental property damage or injuries. Together, this “trust package” signals professionalism and protects everyone involved.

Generally, yes. Business licenses are typically issued at the city or county level, so you’ll need licenses for each municipality where you operate. If you expand your cleaning business across state lines, you’ll also need to register as a foreign LLC in each new state and comply with that state’s specific requirements.

Generally, yes. Business licenses are typically issued at the city or county level, so you’ll need licenses for each municipality where you operate. If you expand your cleaning business across state lines, you’ll also need to register as a foreign LLC in each new state and comply with that state’s specific requirements.

Most cleaning business owners can complete all licensing in 1-2 weeks. The EIN takes about 10 minutes online. General business licenses typically process in 1-5 business days. LLC formation varies by state (1 day to 2 weeks). Insurance and bonding can often be purchased same-day. Plan ahead so you’re not waiting on paperwork when you’re ready to start working.