Overview

If you’re manually entering the same job information into both your field service software and QuickBooks, you’re wasting precious hours that could be spent growing your business. The average field service company spends 15+ hours per week on duplicate data entry, creating invoices manually, and reconciling financial records between systems.

This tedious process isn’t just time-consuming – it’s error-prone. Manual data transfer leads to pricing mistakes, missed charges for materials, incorrect tax calculations, and delayed invoicing that hurts your cash flow. Meanwhile, your books stay out of sync, making it difficult to understand your true profitability or make informed business decisions.

Our QuickBooks sync and invoice automation workflow eliminates these pain points completely. The moment a technician marks a job as complete in FieldCamp, the system automatically extracts all job data, calculates accurate totals with proper markup and taxes, creates a professional invoice in QuickBooks, and sends it to your customer – all without any manual intervention.

Whether you’re an HVAC contractor managing complex installations, a plumbing business tracking parts and labor across multiple jobs, or a multi-trade company needing accurate job costing, this automation ensures your financial records are always accurate, up-to-date, and profitable.

Implementation Results

Field service companies using automated customer updates see dramatic improvements:

94%

Data Entry Time Saved

99.2%

Billing Accuracy Improved

87%

Invoicing Speed Increased

43%

Cash Flow Accelerated 23 days faster

Results based on FieldCamp customer data from 300+ QuickBooks-integrated businesses over 24 months

Key Benefits

- Eliminate Double Data Entry Forever Enter job information once in FieldCamp and watch it automatically flow to QuickBooks with perfect accuracy. No more typing the same customer details, line items, or costs twice. The integration handles everything from basic service calls to complex multi-day projects.

- Get Paid Faster with Instant Invoicing Invoices are created and sent the moment jobs are completed, instead of waiting for end-of-day or weekly batch processing. This immediate invoicing typically accelerates payment by 2-3 weeks, dramatically improving your cash flow.

- Ensure 100% Billing Accuracy Automated calculations eliminate human errors in pricing, tax computation, and markup application. Every job is billed at your correct rates with proper categorization, ensuring you never miss charging for materials or underestimate labor costs.

- Maintain Real-Time Financial Visibility Your QuickBooks data stays current throughout the day, giving you instant insight into daily revenue, job profitability, and customer payment status. Make informed decisions based on up-to-the-minute financial information instead of waiting for month-end reports.

- Scale Without Administrative Burden Handle 10x more jobs without adding accounting staff. The automation scales effortlessly whether you complete 20 or 200 jobs per month, maintaining the same accuracy and speed regardless of volume.

- Simplify Tax Preparation and Reporting Proper categorization and real-time journal entries ensure your books are always audit-ready. Tax preparation becomes straightforward when every transaction is correctly classified and reconciled from day one.

Key Features

- Intelligent Data Mapping The system automatically maps FieldCamp job data to appropriate QuickBooks accounts, items, and categories. Labor hours flow to service items, materials sync with inventory, and customer information updates seamlessly without manual configuration.

- Dynamic Pricing Calculations Automatically applies your markup rules, tax rates, and discount policies to every invoice. The system can handle complex pricing structures including time-based labor rates, quantity discounts, and customer-specific pricing agreements.

- Professional Invoice Generation Creates branded QuickBooks invoices that match your company’s professional image. Includes detailed line items, photos from the job site, terms and conditions, and secure payment portal links for immediate customer payment.

- Comprehensive Journal Entry Creation Automatically generates proper journal entries for job costs, including labor allocation, material costs, and overhead distribution. This ensures accurate job costing and profitability analysis for every completed project.

- Customer Account Synchronization Keeps customer information, payment terms, credit limits, and contact details synchronized between FieldCamp and QuickBooks. Changes made in either system automatically update in the other, maintaining data consistency.

- Payment Integration Management Coordinates with payment processors to automatically record payments in QuickBooks when customers pay online. This creates a complete audit trail from job completion through payment collection.

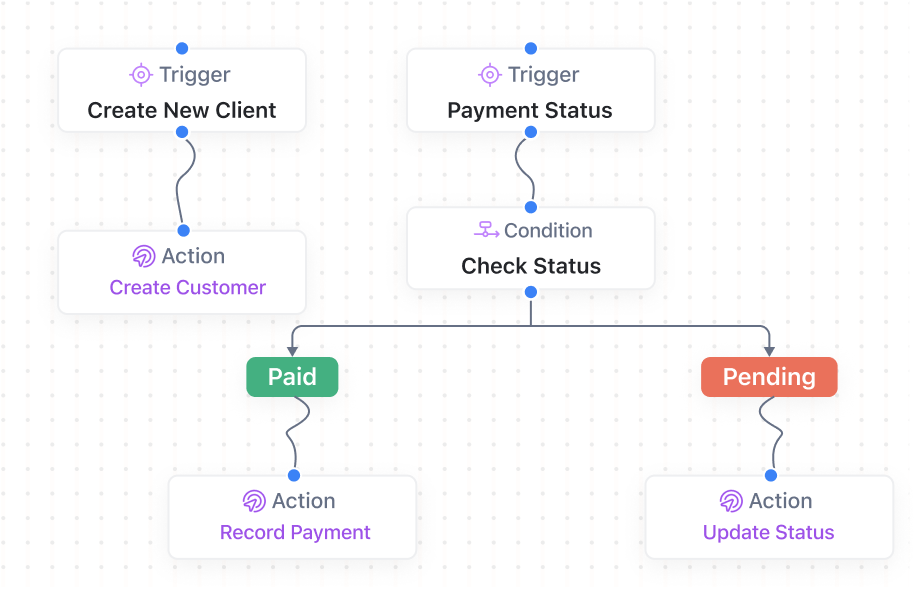

How Our QuickBooks Integration Works

Job Completion Trigger When a technician marks a job as “Completed” in the FieldCamp mobile app, the system immediately captures all job details including labor hours, materials used, customer information, photos, and any additional notes or charges.

Data Extraction and Validation The system extracts and validates all billable items, ensuring labor hours are accurate, materials are properly categorized, and customer information is complete. Any missing data triggers alerts for quick resolution before invoice creation.

Automated Calculation Processing Advanced calculation engine applies your predefined markup rates, tax rules, and discount policies. Labor is calculated at appropriate rates (regular, overtime, holiday), materials include markup, and taxes are computed based on customer location and service type.

QuickBooks Invoice Creation A professional invoice is automatically created in QuickBooks with proper item categorization, customer classification, and account coding. The invoice includes detailed line items, job photos if applicable, and your standard terms and conditions.

Customer Communication The system immediately sends a branded email to the customer containing the invoice, payment portal link, job summary, and contact information for questions. Customers can pay instantly via credit card, ACH, or other configured payment methods.

Financial Record Updates Corresponding journal entries are automatically created for job costs, including labor allocation to appropriate expense accounts, material costs against inventory, and revenue recognition. This maintains accurate job costing and profitability tracking.

Payment Monitoring Setup The invoice is automatically added to your payment reminder sequence, ensuring timely follow-up if payment isn’t received within your standard terms. The system tracks payment status and updates both FieldCamp and QuickBooks when payment is received.

How to Setup the Template

Step 1: Connect QuickBooks Account Authorize FieldCamp to access your QuickBooks Online account using secure OAuth authentication. The system will automatically import your chart of accounts, customer list, and item catalog for mapping configuration.

Step 2: Configure Data Mapping Map FieldCamp service types to QuickBooks items, set up labor categories with appropriate hourly rates, and configure material items with markup rules. This one-time setup ensures all future jobs are categorized correctly.

Step 3: Set Pricing and Tax Rules Configure your markup percentages for materials, set labor rates for different service types, and establish tax rules based on your service areas. The system can handle multiple tax rates and complex pricing structures.

Step 4: Customize Invoice Templates Select your preferred QuickBooks invoice template and customize it with your branding, terms, and payment portal information. Configure which job details and photos should be included on customer invoices.

Step 5: Test Integration Flow Run test invoices with sample job data to ensure all calculations, mappings, and formatting work correctly. FieldCamp support provides guided testing to verify everything functions perfectly before going live.

The complete setup typically takes 2-3 hours with FieldCamp’s dedicated onboarding specialist ensuring your specific business requirements are properly configured.

Who Should Use This Template

Multi-Trade Contractors Businesses offering HVAC, plumbing, and electrical services need accurate job costing across different service types. The integration ensures each trade’s unique pricing and cost structures are properly tracked in QuickBooks.

High-Volume Service Companies Companies completing 50+ jobs per month cannot afford manual invoice creation delays. Automated processing ensures every job is billed immediately without administrative bottlenecks.

Growing Field Service Businesses Businesses expanding beyond owner-operator status need professional financial management without hiring dedicated bookkeeping staff. The automation provides enterprise-level accuracy at small business scale.

Project-Based Service Providers Companies handling complex installations or multi-day projects benefit from detailed job costing and progress billing capabilities that maintain accurate profitability tracking throughout project lifecycles.

Franchise and Multi-Location Operations Businesses with multiple locations or franchise requirements need consistent financial reporting and standardized invoicing processes across all operations.

Frequently Asked Questions

Will this work with QuickBooks Desktop?

Currently, the integration works with QuickBooks Online. QuickBooks Desktop integration is planned for future release. We recommend migrating to QuickBooks Online for the best automation experience and ongoing feature updates.

What happens if there’s an error in the automated invoice?

The system includes validation checks to prevent errors, but if adjustments are needed, you can modify invoices in QuickBooks normally. Changes made in QuickBooks are tracked but don’t affect the original FieldCamp job record.

Can I customize which job details appear on invoices?

Yes, you have complete control over invoice content including line item details, job photos, technician notes, and additional charges. Configure templates to match your preferred level of detail for different service types.

Template Details

Category

Financial Integration

Use Case

All field service businesses using QuickBooks Online for accounting

Requirements

- QuickBooks Online subscription (Simple Start or higher)

- FieldCamp account with invoicing enabled

- Payment processor integration (Stripe)

- Email system for customer communications

- Properly configured chart of accounts in QuickBooks