Cleaning Industry Trends 2026: 9 Data-Backed Insights Shaping the Market

January 27, 2026 - 15 min read

January 27, 2026 - 15 min read

Table of Contents

| TL;DR: The cleaning industry is booming, but the rules have changed. Market growth is accelerating, yet nearly half of cleaning businesses are turning down work because they can’t find staff. The companies pulling ahead aren’t just working harder. They’re automating scheduling, adopting green cleaning as standard, and exploring hybrid human-robot service models. Sustainability has shifted from a selling point to a baseline expectation for winning commercial contracts. If you’re still running operations manually, you’re already behind. |

Cleaning has always been a grind. Long hours with tight margins and clients who expect everything yesterday.

But something’s different now. The industry is growing like crazy, yet most cleaning business owners feel more stuck than ever. You can’t find reliable workers. The ones you do find don’t stick around.

And somewhere along the way, your competitors started landing bigger janitorial services contracts while you’re still buried in scheduling spreadsheets.

Here’s what’s actually happening: the businesses pulling ahead aren’t outworking you. They’re just not doing everything manually anymore. They’re using cleaning software to handle the busywork so they can focus on the stuff that actually grows the business.

This guide breaks down the 9 trends shaping the cleaning industry in 2026. No fluff. Just what’s working, what’s changing, and what you can do about it.

KEY HIGHLIGHTS

Cleaning Industry Trends for 2026

| Year | Market Size | Annual Growth |

| 2024 | $443.86 billion | – |

| 2025 | $451.63 billion | +1.7% |

| 2026 | $472.22 billion | +4.6% |

| 2030 | $616.98 billion | 7.1% CAGR |

| 2035 | $881.33 billion | 7.1% CAGR |

Sources: Research Nester, Fortune Business Insights

If you prefer listening instead, check out the podcast below!

The cleaning industry’s expansion isn’t random. It’s being shaped by specific forces: post-pandemic hygiene expectations that never went away, a severe labor crunch pushing cleaning contractors toward automation, sustainability mandates from corporate clients, and AI tools that are finally mature enough to deliver real ROI.

The 9 trends below break down exactly what’s happening, why it matters, and how cleaning businesses are responding.

The cleaning services market isn’t just growing. It’s accelerating.

The numbers:

What’s driving it: Post-pandemic hygiene standards that stuck, dual-income households outsourcing residential cleaning services, corporate return-to-office mandates increasing demand for office cleaning, and healthcare facility management expansion.

The cleaning industry isn’t distributed evenly. Urban areas with commercial density and healthcare facilities are seeing the biggest jumps. Tracking which zip codes and service types are growing in your region is the difference between chasing leads and capturing demand.

Tools like Field Service Reporting Software help you spot these patterns in your own booking data so you can focus marketing where it matters.

Key Takeaway: The cleaning market is growing 7.1% annually, but the real opportunity is in commercial janitorial contracts and healthcare, not general residential.

Looking to capture more of this growing market? Learn how to get clients for your cleaning business with proven strategies.

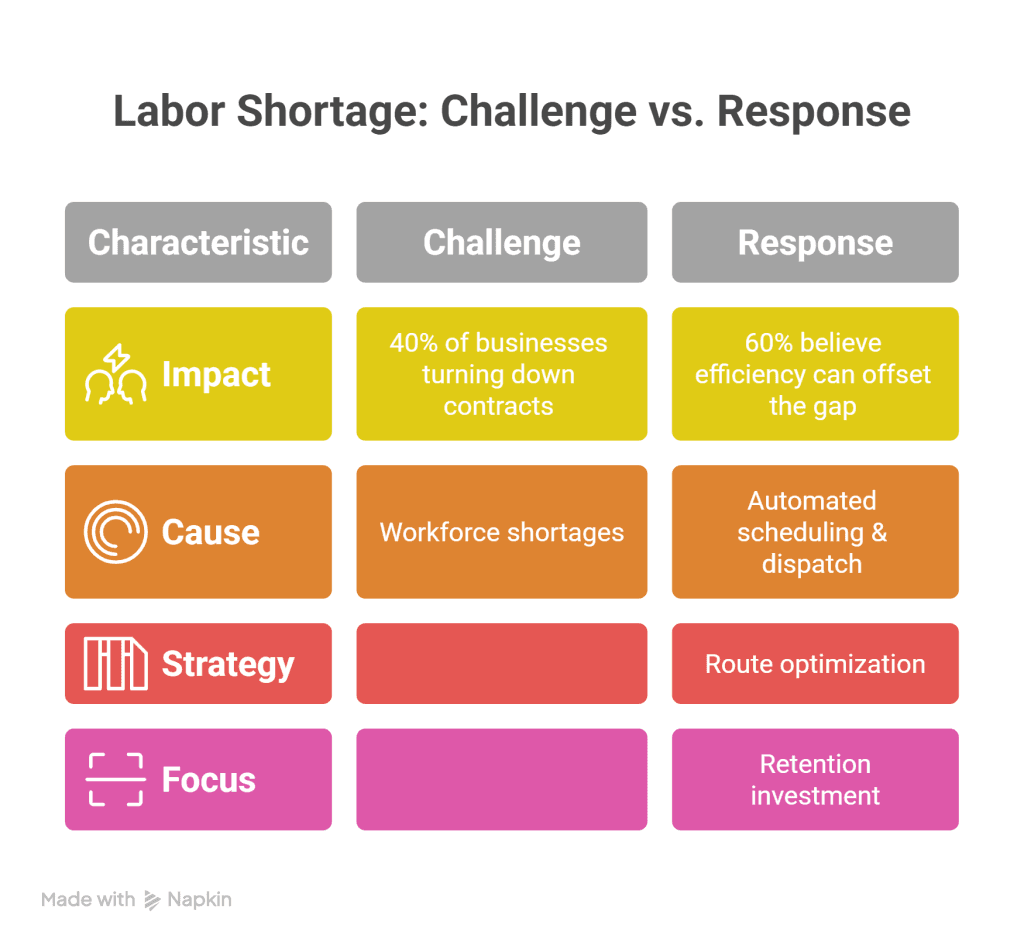

This is the elephant in the room. Every cleaning business owner is feeling it.

The data:

Why it’s happening: Wages in competing industries have risen, younger workers see cleaning as transitional, and physical demands lead to high turnover among cleaning staff.

How smart operators respond: Automate scheduling and dispatch, use route optimization for more jobs per cleaning crew per day, and invest in retention through better pay and flexible schedules.

The businesses winning right now are making each worker more productive through better tools and tighter workflows. AI Dispatch Software assigns the right cleaner to the right job based on location, skills, and availability, eliminating the back-and-forth that eats up manager time.

Key Takeaway: You can’t hire your way out of the labor shortage. The winning strategy is making each worker more productive through automation.

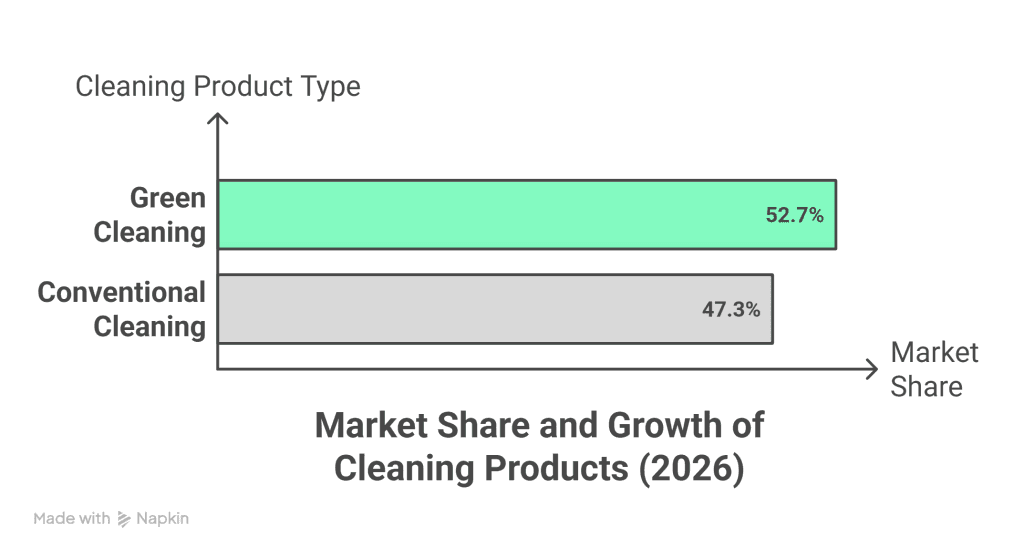

Sustainability moved from “nice to have” to “required” faster than most expected.

The numbers:

What’s driving it: Corporate ESG requirements, indoor air quality concerns, regulatory pressure on cleaning chemicals, and genuine consumer preference.

If you’re not offering green cleaning options, you’re getting filtered out of RFPs before anyone reads your proposal. The good news is that sustainable cleaning products and eco-friendly cleaning equipment have gotten cheaper and more effective over the past few years.

Document your environmental practices clearly. Keep certifications, compliance records, and sustainability statements organized and accessible.

Reliable file management software helps you store and share these documents instantly when clients or facility managers request proof of your green credentials.

Certifications help, but even a straightforward statement of your methods on your website and in proposals makes a difference when clients are comparing vendors.

Key Takeaway: Sustainability isn’t a differentiator anymore. It’s the baseline. No green options means no seat at the table for commercial contracts.

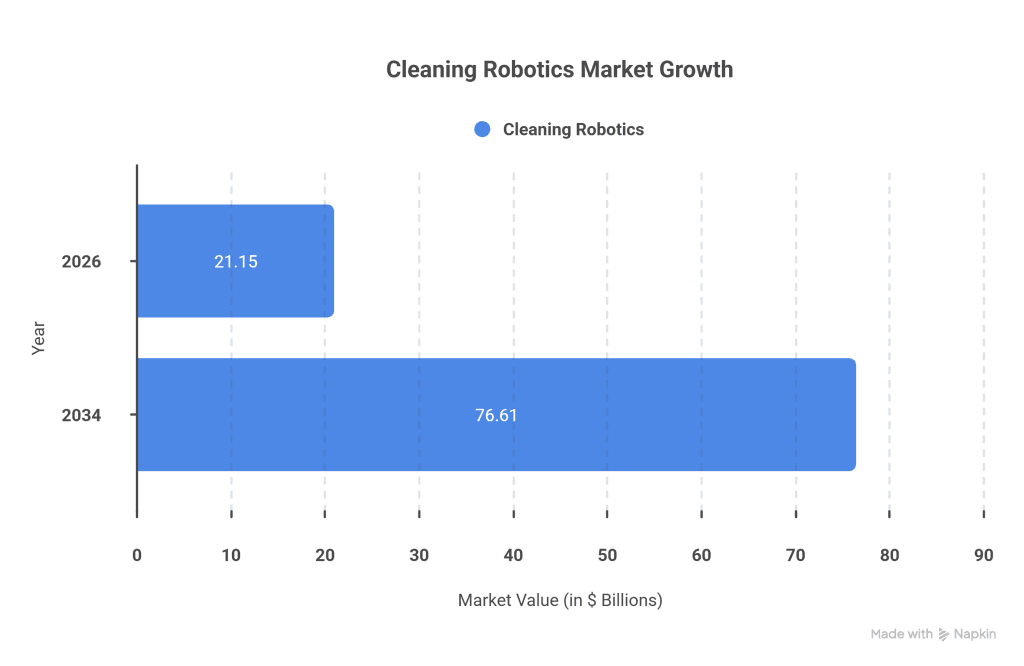

This isn’t science fiction anymore. Robots are cleaning airports, malls, hospitals, and office buildings right now.

The market:

The hybrid model: Robots handle repetitive floor maintenance, sanitation, and routine cleaning tasks; humans do detailed deep cleaning work. Leading companies offer “hybrid service packages” that combine weekly robotic maintenance with monthly human deep cleaning.

You don’t need to invest in cleaning equipment like robots tomorrow, but expect large commercial clients to start asking about automation capabilities. For smaller janitorial services operators, robot rentals and partnerships with robotics providers are emerging as accessible options.

The companies paying attention to this trend now will be better positioned when automation becomes a standard expectation in RFPs.

Key Takeaway: The $21 billion cleaning robotics market is growing 17.5% annually. Hybrid human-robot service models are the emerging standard for commercial contracts.

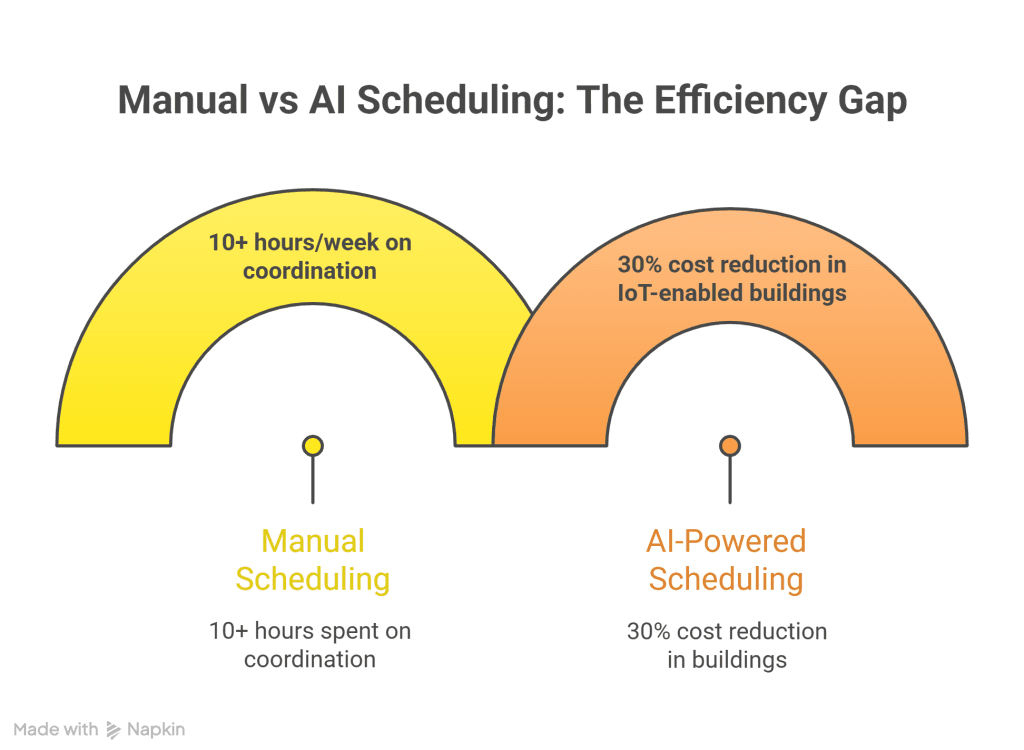

Manual scheduling is becoming a competitive disadvantage for professional cleaning companies.

What’s changed:

What AI scheduling does: Predicts accurate time slots from job history, auto-reassigns when someone calls in sick, optimizes routes based on traffic, and learns which cleaning staff perform best at which job types.

The business impact: Fewer gaps between jobs, more accurate arrival windows, reduced overtime, and less time on calendar management. Every hour saved on admin is an hour you can spend on sales, training, or quality control.

AI Job Scheduling Software compounds these efficiency gains over time, learning from your data to make smarter assignments with each passing week.

Key Takeaway: AI scheduling isn’t about replacing managers. It’s about eliminating the 10+ hours weekly spent on manual coordination.

Want to see how AI is already transforming the industry? Read our deep dive on AI cleaning services.

The days of rigid packages and opaque pricing are over for cleaning service providers.

What clients want now:

Why: Hybrid work changed office cleaning occupancy patterns. Subscription fatigue means people want to pay for what they use. Commercial clients have variable facility management budgets quarter to quarter.

The solution: Automation. When clients self-serve changes through a booking portal that auto-updates your schedule, you get flexibility without admin chaos.

When quotes are itemized and pricing logic is clear, clients trust you more and pay faster. Track your quote acceptance rates quarterly.

If you’re winning 90% of quotes, you’re probably too cheap. If you’re winning 30%, you’re either too expensive or not communicating value.

Field Service Job Quoting helps you generate professional, itemized quotes quickly and track which ones convert so you can refine your pricing strategy over time.

Key Takeaway: Rigid packages and opaque pricing lose clients. Automation lets you offer flexibility without creating admin chaos.

Not sure where to start with pricing? Here’s a complete guide on how to charge for cleaning services.

In 2026, your Google rating is your storefront.

The reality: 93% of consumers read reviews before choosing a local cleaning service. A one-star increase can drive 5-9% revenue growth.

What works: Consistent service quality, asking for reviews right after successful jobs, responding to all reviews (positive and negative), and making feedback one-click easy.

The referral connection: Reviews and referrals feed each other. A client who leaves a positive review is more likely to refer your residential cleaning services or commercial janitorial work to others.

A referred client is more likely to leave a positive review. Build systems that encourage both. Automate review requests within 24 hours of job completion while the experience is still fresh.

And always respond professionally to negative reviews, because potential clients are watching how you handle problems just as closely as they’re reading the praise.

Key Takeaway: Your Google rating is your storefront. One star up can mean 5-9% more revenue. Automate review requests and respond to every review.

Want to boost your online visibility beyond reviews? Learn SEO for cleaning business to rank higher in local search.

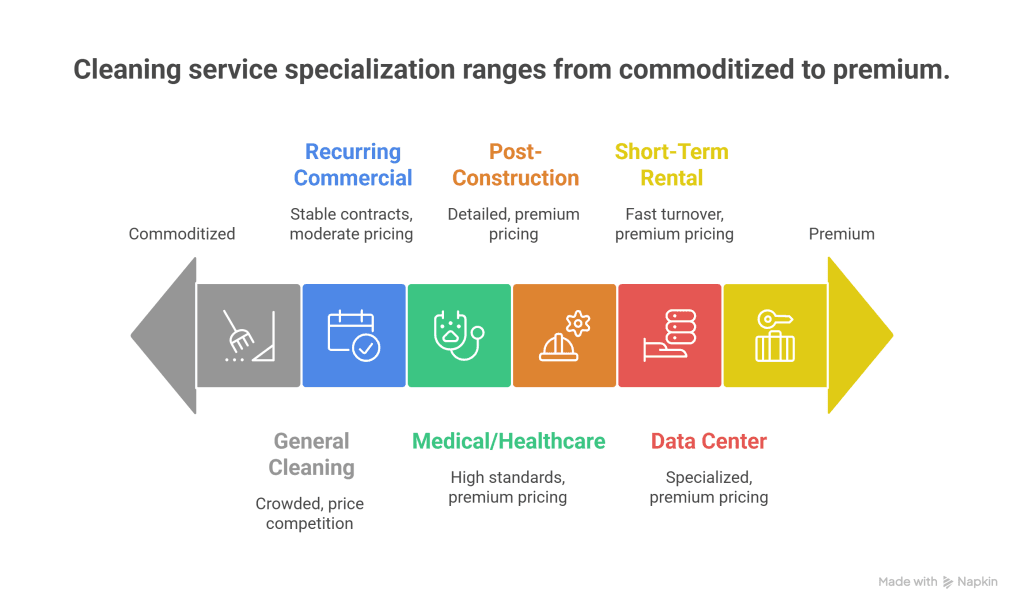

Generalist cleaning is becoming commoditized. Specialist cleaning contractors are thriving.

High-demand specializations:

Why it works: Less price competition, higher barriers to entry, clients value expertise over lowest price, and recurring contracts provide predictable revenue.

The opportunity: The antimicrobial coatings market is hitting $20.1 billion by 2026 (up from $9.8B in 2020), and it’s a disinfection service add-on that many cleaning companies aren’t offering yet. Pick one or two niches that match your market and invest in training and certifications.

A cleaning company known for healthcare facility expertise will win those contracts over a generalist every time. Consider certifications through ISSA or BSCAI to build credibility in your chosen specialization.

Key Takeaway: Generalists compete on price. Specialists compete on expertise. Pick a niche, get certified, and own it.

Finding and keeping good cleaners is hard. AI is making it slightly easier.

The data:

How AI helps: Resume screening for reliability signals, skills matching for role fit, personalized training paths for cleaning staff, and early warning signs for disengagement.

Let AI handle initial screening so you can focus on final interviews and culture fit. Document your processes, because even simple training videos create consistency and reduce the time senior cleaning crew members spend onboarding new hires.

The goal isn’t to remove the human element from hiring. It’s to free up your time for the decisions that actually require judgment, like assessing whether someone will fit your team culture and grow with your company.

Key Takeaway: Let AI handle screening and onboarding busywork. Save your time for the decisions that actually need human judgment.

The pattern across all 9 trends: businesses that systematize and automate are winning.

This doesn’t mean becoming a tech company. It means using cleaning business software that handles operational complexity so you can focus on what actually grows a professional cleaning business: great service, strong relationships, and smart strategy.

The market is growing. The question is whether you’re positioned to capture your share.

Smart operators are already using Cleaning Software to automate scheduling, dispatching, and client communication.

The hours you save on manual coordination are hours you can reinvest in sales, training, and service quality.

Adapt or Fall Behind.

The cleaning businesses winning in 2026 aren’t working harder. They’re running leaner operations with smarter tools.

No. Despite the number of cleaning businesses, demand continues to outpace supply in most markets. The real challenge isn’t competition; it’s finding and retaining workers. Cleaning contractors that specialize in high-demand niches like healthcare facility cleaning, post-construction cleanup, or short-term rental turnover face even less saturation.

Labor shortages are driving automation, green cleaning is becoming the default for commercial contracts, AI-powered scheduling and dispatch, cleaning robots are entering mainstream use, and specialized janitorial services are commanding premium pricing. The common thread is technology enabling companies to do more with fewer resources.

Directly. Businesses that adopt AI scheduling see reduced overtime and fewer gaps between jobs. Green cleaning opens doors to corporate contracts with ESG requirements. Specialization reduces price competition. Ignoring these shifts means competing on price alone, which shrinks margins for cleaning service providers.

AI-powered job scheduling and dispatch software (for route optimization and automatic job assignment), digital platforms for quality audits and reporting, IoT sensors for monitoring cleaning needs in smart buildings, and AI-assisted hiring tools for candidate screening. 62% of commercial cleaning companies now invest in at least one of these categories.

Labor shortages. 40% of professional cleaning businesses cite workforce constraints as their primary challenge.

$21.15 billion in 2026, projected to reach $76.61 billion by 2034 (17.5% annual growth).

Technology-driven operations, sustainability as default, hybrid human-robot models for routine cleaning and deep cleaning tasks, and specialized services commanding premium prices.