How Much to Charge Per Hour as a Field Service Contractor?

June 18, 2025 - 18 min read

June 18, 2025 - 18 min read

Table of Contents

| TL;DR Setting your hourly rate isn’t about copying competitors; it’s about covering your real costs and securing sustainable profit. This guide shows you how to factor in labor burden, overhead, and markup, and includes a free calculator to help you price confidently in minutes. |

Field service contractors may earn $24.83/hour as employees in 2025, but savvy field businesses running their own business or managing a small crew often charge $75–$150/hour for the same skills.

That difference isn’t random; it’s about understanding that your rate must cover everything: tools, vehicle costs, insurance, admin overhead, tax responsibilities, and healthy profit margins.

Rates also vary wildly by region; some markets show $40/hour gaps between the low and high ends. Whether you’re running an HVAC, plumbing, or electrical business, the most successful contractors use value-based pricing instead of racing to the bottom.

Field service rates have risen by 8% recently due to inflation, equipment costs, and labor shortages. The contractors thriving today treat pricing as a business strategy, not a guess. They rely on proven pricing strategy frameworks, not gut feeling. Tools like our service cost calculator make it easier to analyze your costs and set rates that ensure profitability analytics.

This guide walks you through those exact formulas: how to set profitable hourly rates, pick the right pricing model for your service type, and confidently present yourself as a premium provider.

Stop leaving money on the table; it’s time to charge what your expertise is truly worth.

KEY HIGHLIGHTS

Master Your Hourly Rate Strategy

Here’s what field service contractors are charging per hour in 2025, based on real market data:

| Service Type | Employee Wage | Contractor Hourly Rate | Markup Factor |

| General Field Service | $18-$35/hr | $50-$90/hr | 2.5-3x |

| HVAC Technician | $25-$40/hr | $75-$150/hr | 3-3.5x |

| Plumber | $22-$38/hr | $75-$125/hr | 3-3.5x |

| Electrician | $23-$42/hr | $65-$120/hr | 2.8-3x |

| Handyman | $16-$28/hr | $45-$85/hr | 2.5-3x |

| Landscaper | $16-$25/hr | $45-$85/hr | 2.5-3x |

These numbers represent what successful contractors are billing clients in 2025, not what they pay themselves or their employees. The markup factor shows the multiplier applied to employee wages to reach profitable billing rates.

For example, if you’re an HVAC technician who previously earned $30/hour as an employee, you should charge clients $90-$105/hour as a contractor to cover all your business costs and earn a reasonable profit.

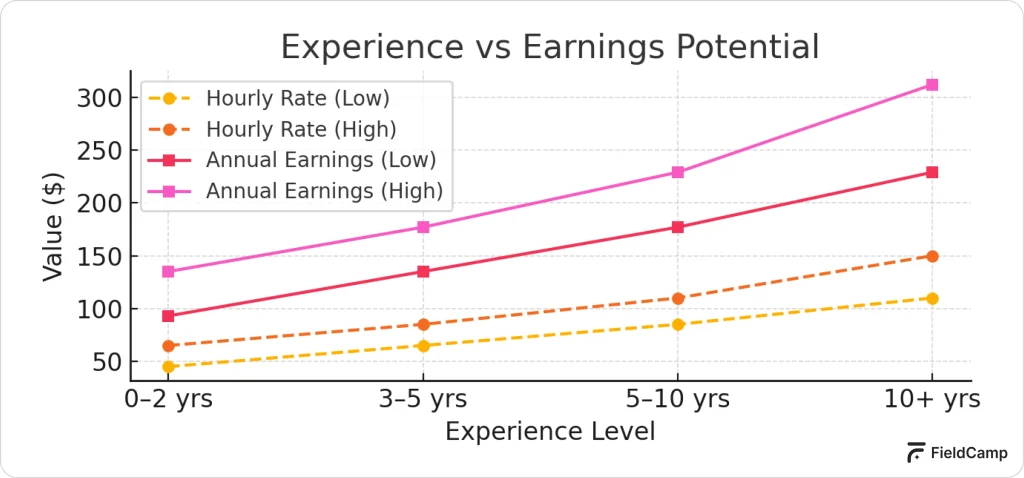

Your years in business directly affect how much money you can charge:

| Experience Level | Hourly Rate Range | Annual Potential |

| New Business (0-2 years) | $45-$65/hr | $93K-$135K |

| Established (3-5 years) | $65-$85/hr | $135K-$177K |

| Experienced (5-10 years) | $85-$110/hr | $177K-$229K |

| Expert (10+ years) | $110-$150+/hr | $229K-$312K+ |

Remember: These aren’t take-home numbers. They’re what you need to charge to run a profitable business that covers all business costs and overhead expenses.

New contractors often feel pressured to charge less to “get their foot in the door,” but this is a dangerous trap. Even at the entry level, you still have the same business expenses as experienced contractors—vehicle costs, insurance, tools, and overhead expenses.

The difference is that experienced contractors have built reputations that allow them to charge premium rates and be more selective about clients.

The biggest mistake? Thinking like an employee instead of a business owner.

Here’s the reality check: If you pay yourself $30/hour, you need to charge clients $75-$100/hour minimum.

Where Your $100/Hour Goes:

Your hourly rate isn’t just your wage—it covers every cost of running a business. Out of $100/hour, around $25–$33 goes toward your salary, while $12–$15 covers employment taxes, $8–$10 is for insurance and licensing and $10–$15 supports your vehicle and equipment.

You’ll also spend $15–$20 on overhead expensesareyou should keep $15–$25 as profit margin. This breakdown helps you price smartly—not just to survive, but to thrive.

Track Every Hidden Cost with FieldCamp!

Stop missing the small expenses that add up to big losses. FieldCamp automatically logs all your job details, mileage, materials, and overhead costs so nothing falls through the cracks. Start using FieldCamp for free now.

Real Example: Sarah runs a small plumbing company and wants to pay herself $40/hour. Here’s her true cost breakdown:

Follow this comprehensive step-by-step process to determine your minimum hourly rate. This isn’t guesswork; it’s a systematic approach that ensures you cover all costs and earn a sustainable profit.

Start by deciding what you want to earn as personal income from your own business before any expenses. This is your target salary—what you’d want to make if someone else employed you.

Consider your local market when setting this number. A $60,000 salary in rural Kansas provides a different lifestyle than $60,000 in San Francisco. Research median incomes in your area using sites like PayScale or Glassdoor to ensure your target is realistic.

This is where most contractors make their biggest mistake—overestimating how many hours they can bill.

They assume they can bill 40 hours per week, 52 weeks per year (2,080 hours). This is entirely unrealistic.

Total possible hours: 2,080 (40 hours × 52 weeks)

Subtract non-billable time:

Realistic billable hours = Total possible hours – non-billable hours

2080 – 960 = 1,120-1,400 per year (depending on efficiency)

Your hourly rate needs to recover every dollar in yearly expenses—from fuel and software to tools and training. Missing even small expenses can cost you thousands annually.

Vehicle Costs:

Business Operations:

Office/Administrative:

Total annual overhead: $25,000-$50,000 (varies by business size)

Now you can determine your minimum hourly rate using this formula:

Formula: Minimum Hourly Rate = (Desired Salary + Annual Overhead) ÷ Billable Hours

Example:

Minimum rate: ($75,000 + $35,000) ÷ 1,300 = $84.62/hour

This is your minimum hourly rate. You must charge at least this amount to stay profitable, cover all costs, and pay yourself your target salary.

But you’re not done yet—you still need to add profit.

Your calculated rate covers costs but does not include profit for business growth, emergencies, or return on investment. Every successful business needs to generate a profit to survive and thrive.

| Desired Profit Margin | Markup Multiplier | Applied to Example |

| 15% | 1.18 | $84.62 × 1.18 = $99.85/hour |

| 20% | 1.25 | $84.62 × 1.25 = $105.77/hour |

| 25% | 1.33 | $84.62 × 1.33 = $112.54/hour |

| 30% | 1.43 | $84.62 × 1.43 = $121.00/hour |

Most successful contractors target 20-25% profit margins. This provides an adequate cushion for unexpected events while funding growth opportunities.

Know exactly what you’re making. FieldCamp’s free profit margin calculator breaks down your labor, materials, and overhead to reveal your real profit, markup, and hourly return in seconds.

Your hourly pricing shouldn’t be the same price for every job. Smart contractors adjust rates based on multiple factors that affect the difficulty, risk, and value of their services.

Urban markets command higher rates for several reasons. The cost of living is higher, so customers expect to pay more for services. Traffic congestion increases travel time between jobs, reducing your efficiency. Parking and access can be challenging, adding complexity to simple jobs.

1. Major Urban Areas (+30-50% above national average):

Urban markets command higher rates for several reasons. The cost of living is higher, so customers expect to pay more for services. Traffic congestion increases travel time between jobs, reducing your efficiency. Parking and access can be challenging, adding complexity to even the simplest jobs.

Examples:

In these markets, customers are accustomed to premium pricing for professional services. A $120/hour rate that might shock a rural customer is perfectly acceptable in Manhattan.

2. Suburban Markets (Baseline rates):

Suburban areas typically offer the sweet spot for many contractors. Customers have disposable income but aren’t dealing with extreme urban costs. Travel between jobs is manageable, and you can often build a concentrated customer base in specific neighborhoods.

Examples:

Suburban customers often become long-term clients, referring neighbors and providing steady repeat business that allows you to maintain consistent rates.

3. Rural Areas (-15-25% below national average):

Rural markets present unique challenges and opportunities. While rates are generally lower, your competition may be limited. Customers may be more price-sensitive, but they also value reliability and are willing to pay fair rates for dependable service.

Examples:

4. Remote Locations (+20-40% above baseline):

Islands, mountain areas, and other remote locations often support premium pricing due to limited competition and higher operating costs. Fuel costs, travel time, and difficulty accessing suppliers justify higher rates.

Not all services are created equal. The complexity, risk, and expertise required for different types of work should be reflected in your hourly rate.

Premium Rate Services (+25-50% higher hourly rate):

Standard Rate Services:

Volume Discount Services (-10-20%):

Your track record and reputation directly impact what customers are willing to pay. This isn’t just about years in business; it’s about the credibility indicators that make customers confident in your expertise.

Rate increases based on credibility:

Building your reputation helps you charge higher rates because clients pay more for:

Choosing the right pricing model is crucial for maximizing profitability while meeting customer expectations. Different jobs require different approaches, and successful contractors master multiple pricing strategies.

Hourly pricing is most effective when the scope of work is uncertain or when the customer prefers transparent, pay-as-you-go billing.

Best for:

Hourly Rate Structure Example:

Fixed price contracts work best for well-defined work where you can accurately estimate time and materials. They often result in higher customer satisfaction and can be more profitable if you’re efficient.

Best for:

Fixed Price Formula: Fixed Price = (Estimated Hours × Hourly Rate) × 1.1 safety factor

Example: Installing a water heater

Many successful contractors combine both hourly and fixed pricing to maximize profitability and customer satisfaction.

| Service Component | Pricing Method | Rate |

| Service call | Fixed amount | $85 |

| Diagnostic time | Hourly rate | $95/hour |

| Standard repairs | Fixed price | Varies |

| Additional work | Hourly rate | $85/hour |

Not all jobs are created equal, even within the same trade. A bathroom faucet replacement in a new home is entirely different from the same job in a 100-year-old house with corroded pipes and no shutoff valves.

Simple Jobs (1.0x base rate):

Medium Complexity (1.2-1.5x base rate):

High Complexity (1.5-2.0x base rate):

Access Difficulty:

Working Conditions:

Equipment Requirements:

Every business expense should be factored into your pricing. Here’s what to include:

Don’t spend hours manually calculating payroll taxes, workers’ comp rates, and benefit costs for each scenario. Our free labor cost calculator does the complex math automatically based on your state, trade, and desired salary.

Always include 5-10% for:

Don’t spend hours manually calculating payroll taxes, workers’ comp rates, and benefit costs for each scenario. Our free labor cost calculator does the complex math automatically based on your state, trade, and desired salary.

Location has a significant impact on what you can charge. Here’s how to research and adjust for your market:

Top-Tier Cities:

Mid-Tier Cities:

Smaller Markets:

1. Mystery Shop Competitors Call 3-5 competitors as a potential customer:

2. Check Online Platforms

3. Network with Suppliers Your supply house knows which contractors are busiest—they often command higher rates.

4. Join Trade Associations Many associations publish annual wage surveys with regional breakdowns.

Avoid these costly errors that keep contractors struggling:

The Result: Accurate hourly rate calculations

When and how to raise your rates without losing good clients:

Immediate increases when:

Most contractors charge $50-$150/hour, depending on trade, location, and experience. Calculate your hourly rate using: (annual salary + business expenses) ÷ billable hours × profit margin.

A good hourly rate covers all business costs plus 20-25% profit margin. HVAC and electrical contractors typically charge $75-$150/hour, while handyman services range $45-$85/hour.

Add your desired salary to total business expenses, divide by realistic billable hours (usually 1,200-1,500 annually), then multiply by 1.2-1.3 for profit margin.

No. Adjust your hourly rate based on complexity. Use standard rates for routine work, premium rates for emergencies, and lower rates for high-volume contracts.

Plan for 25-32 billable hours weekly. Non billable time includes travel, estimates, admin work, and equipment maintenance. New contractors often achieve only 60-70% efficiency.

Use hourly pricing for diagnostic work and unknown scope jobs. Switch to a fixed price for routine services, you can create an accurate estimate, and retain customers.

Include all overhead costs: vehicle expenses, tools, insurance, licenses, office costs, marketing, self-employment taxes, and unexpected expenses. Track actual costs for 90 days.

Review rates quarterly, adjust annually. Raise immediately when business costs increase 5%+, you’re booked solid, or competitors increase their pricing model.RetryClaude can make mistakes. Please double-check responses.