Landscaping Industry Statistics, Trends & Growth to Watch in 2026

May 16, 2025 - 14 min read

May 16, 2025 - 14 min read

Table of Contents

| TL;DR: The US landscaping market tops $184 B, and water-saving tech, outdoor kitchens, and smart-irrigation ( +12 % CAGR) are the fastest-growing niches. Eco designs and AI-driven tools now trim fuel, labor, and costs. Firms bundling sustainable, tech-enabled services will own the next growth wave. |

Picture dawn on a quiet street: birds chirp, sprinklers hiss, and a crew of landscape pros rolls out their mowers. By noon, that plain yard is the block’s favorite outdoor living space. 🌅

Scenes like this power a $116 billion U.S. landscaping services market that’s projected to grow 7.3 percent a year through 2030, according to Grand View Research.

Industry leaders claim that, on average, millennials and new homeowners spend about $200-300 a year on lawn care, while commercial properties chase the same curb appeal.

But customer priorities are changing fast. What’s shifting beneath the grass?

Smaller crews, higher fuel prices, and eco‑minded clients now expect economical gear that cuts water usage and air pollution.

To keep up, forward‑looking landscaping businesses pair rakes with AI‑powered landscape management software. The platform plots faster routes, schedules crews, tracks materials, and sends real‑time updates, slashing idle time, water waste, and emissions.

Blending hands‑on craft with smart technology gives every lawn care business a clear path to sustainable growth in 2026 and beyond.

Ready to lead the way?

KEY HIGHLIGHTS

Landscape Industry Lowdown

Fresh numbers show the landscaping industry is expanding more quickly than many other local‑service sectors, creating new room for landscaping businesses and lawn‑care start‑ups.

Trends & statistics:

Increase completed jobs each week while trimming fuel costs—that’s what landscapers report after adopting tools like FieldCamp, an AI‑powered landscape management platform. FieldCamp auto‑schedules crews, optimizes routes, and tracks materials in real time, so even lean teams can take on more lawn‑care work without burning extra fuel.

Future‑Proof Your Landscaping Operations Today

Automate schedules with ease and finish more yards daily with FieldCamp

Our take: The latest landscaping industry statistics show robust, tech‑driven expansion. Companies that blend hands‑on craft with AI efficiency are best placed to seize new demand, overcome labor gaps, and secure sustainable growth through 2026 and beyond.

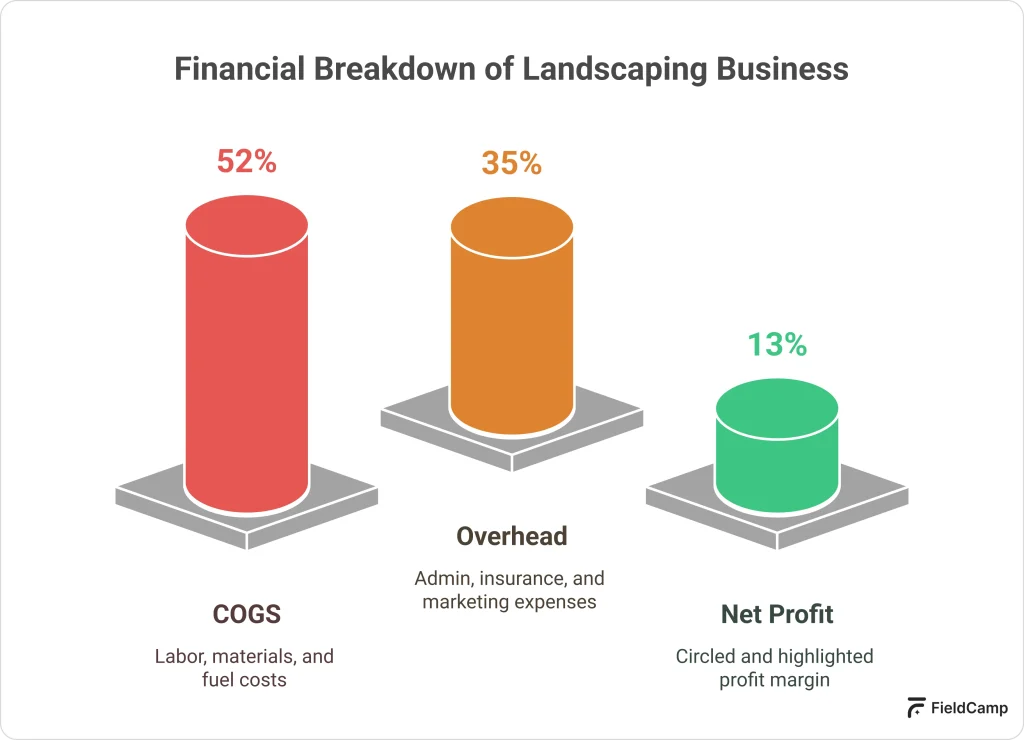

Industry benchmarks put a well-run landscaping company at 10 – 14 % net profit. To hit that range, firms typically aim for a 45 – 50 % gross margin on each job.

Here’s a back-of-the-napkin example at $1 million in annual revenue:

Best-in-class operators who control fuel use, upsell higher-margin services, and trim non-billable time can edge past 15 % net, turning that same $1 million in sales into roughly $150,000 in profit.

Smart pricing strategies and route optimization also play a key role in protecting margins. As competition and costs rise, top performers increasingly rely on software to streamline jobs and maximize billable hours.

Fewer available hands are driving up costs and stretching project timelines for many landscaping businesses.

Trends & stats:

Seasonal work, wage competition with construction, and fewer young workers entering the trades have widened the hiring gap, an increasingly urgent industry challenge.

Cross‑train staff and adopt time‑saving equipment (battery multi‑tools, stand‑on mowers) so crews can cover more ground with fewer people.

Our take: Labor shortages aren’t leaving soon. Businesses that upskill crews and lean on efficiency tools will protect margins while competitors scramble for workers.

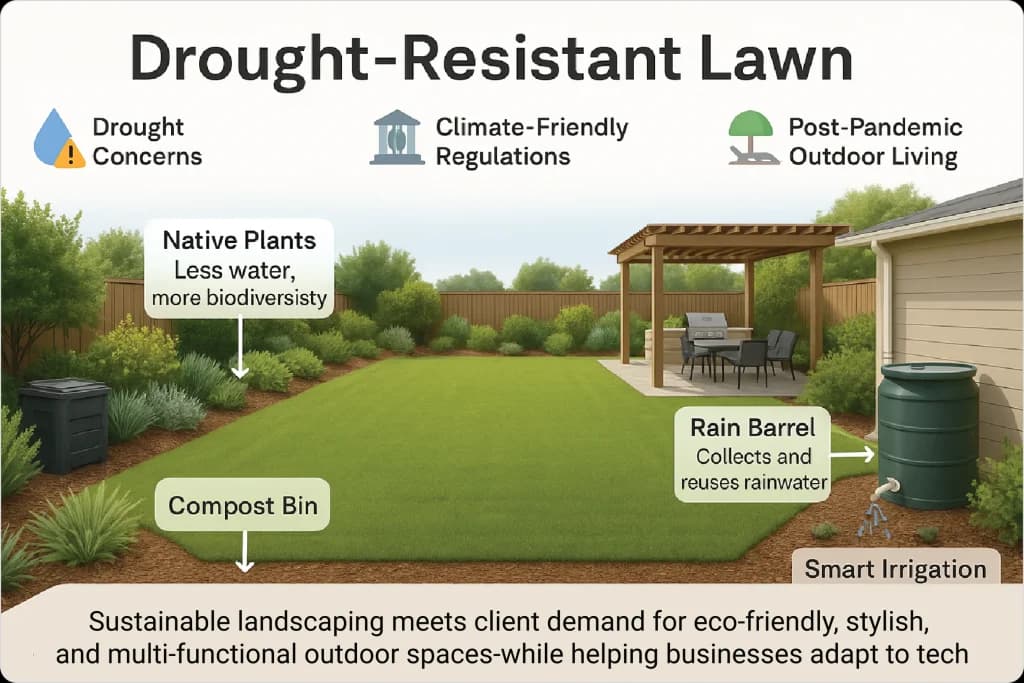

Eco‑friendly requests are moving from niche to normal across residential and commercial landscaping services.

Trends & stats:

Droughts, climate regulations, and rising energy awareness steer clients toward water‑wise designs. Low‑emission gear is a major landscaping industry trend that also reduces long‑term maintenance costs.

Bundle projects that pair native‑plant installs with a smart‑controller retrofit; offer homeowners a quick water‑savings payback chart to close the sale.

Our take: Sustainability isn’t a fad. Firms that position eco packages up front will capture the fastest‑growing slice of the landscaping industry.

Hardware and software advances are reshaping everyday fieldwork—from mower decks to job scheduling apps.

Trends & stats:

Tighter labor pools and fuel costs push companies to extract more output per crew—tech delivers that leverage while satisfying eco‑minded clients.

Start with GPS‑based route planners that sync daily stops to crew phones; measurable fuel savings often pay for the software in one season.

Our take: Whether it’s battery blowers or AI dispatch, tech‑forward landscaping businesses gain a productivity edge and greener brand image.

Outdoor areas are evolving from simple lawns into eco‑smart “rooms” where people cook, relax, and conserve resources.

Trends & statistics:

Drought concerns, climate‑friendly rules, and a post‑pandemic craving for outdoor living have converged.

These preferences create both opportunity and industry challenges for landscaping businesses, squeezing projects into tight labor and fuel budgets.

Bundle an “Outdoor‑Living Upgrade” package: patio or deck plus native‑plant beds and a smart‑irrigation install. One bundled line item taps three hot landscaping industry trends in a single visit and simplifies estimates.

Our take: Current landscaping industry statistics show rising demand for eco‑savvy, comfort‑focused yards. Businesses that package services around these trends and streamline labor and routing can convert shifting client tastes into lasting and steady growth.

Bigger household budgets are turning “just mow it” calls into full‑service, tech‑savvy lawn‑care packages.

Trends & stats:

Remote work keeps people staring at their yards, and inflation nudges them toward predictable monthly fees.

Build a three‑tier menu (Basic / Plus / Eco) anchored to local mowing averages. Stack value‑adds, organic fertilizer, soil testing, and smart‑controller check into the top tier. One click or line‑item sells a complete package instead of a single visit.

Our take: Rising lawn‑care budgets are steering clients toward comprehensive, eco‑friendly packages. Landscaping services that brand clear bundles and manage them efficiently, through smart scheduling and route optimization, can turn this spending shift into predictable, higher‑margin growth.

Accurate pricing hinges on knowing what homeowners already pay for common lawn care tasks.

Trends & stats:

| Free Tool: Use our automated service price calculator to quickly estimate the right pricing for your lawn care services, tailored to job type, frequency, and property size. |

Tie rates to local averages, then package services (mow + fertilize + smart‑controller check) to lift per‑client revenue without nickel‑and‑diming.

Build a three‑tier pricing menu: Offer basic, premium, and eco packages; anchor prices to the $100‑$150 per‑visit norm, then justify premium tiers with add‑ons and water savings.

Our take: Data‑backed pricing beats guesswork. Using industry benchmarks lets you stay competitive while protecting margins from rising costs.

| Learn More: For a comprehensive understanding of effective pricing strategies tailored to the lawn care industry, explore our detailed service pricing guide. |

Drought in the West and heat waves in the Northeast are rewriting planting plans and maintenance calendars.

Trends & stats:

Water restrictions drive xeriscaping and smart irrigation systems out West, while hotter, drier summers elsewhere shorten cool‑season turf windows and boost demand for heat‑tolerant species.

Build regional “survival kits”: drought‑proof plant lists for arid zones, rain‑garden installs for flood‑prone areas, and flexible maintenance schedules that follow shifting weather patterns.

| Region | CAGR & Time-frame | Source |

| United States / North America | ~7 % CAGR (2023-2030) for landscaping services | (Grand View Research) |

| Canada | ~5.2 % CAGR (2022-2027) for landscaping services | (IBISWorld) |

| Asia-Pacific | ~5.2 % CAGR (2023-2030) for landscaping services | (Grand View Research) |

| China urban greening | Urban-greening spend rising about 10 % per year | (World Landscape Architect) |

Our take: Climate‑aligned offerings help landscaping businesses stay compliant, conserve resources, and keep client landscapes thriving despite extremes.

Over the next five years, landscaping firms will navigate tight labor markets, 100-plus city gas-equipment bans, and fuel costs that remain 12 % above pre-pandemic levels. Those same pressures are opening fresh revenue lanes: outdoor-living builds are tracking toward $3.35 billion by 2030, smart-irrigation installs toward $5.8 billion, and snow-removal contracts toward $116 billion.

The global landscaping market is already $350 billion and growing at 6–7 percent annually. Companies that invest in water-saving technologies, turnkey “backyard rooms,” and four-season services will outpace their competitors. Phasing in battery-powered equipment and schedule-optimizing software helps turn rising input costs into new revenue niches.

Together, these moves will future-proof profit margins through 2030, even in the face of inflation and tighter regulations.

The latest landscaping industry analysis shows steady expansion: global landscaping and gardening service market revenue is growing near-7 % annually, powered by outdoor-living upgrades, tighter water rules, and AI-driven efficiency tools. (Grand View Research)

Company data and salary surveys put landscape architects/project managers at the top‐end pay scale, often followed by irrigation designers and commercial account managers. These roles blend design expertise with crew leadership and tech know-how. (Siteline)

Current lawn care industry analysis highlights three drivers: rising consumer spend, strong commercial demand, and adoption of lawn-care software. The lawn care software market itself is growing at 4 % CAGR as firms seek route optimization and real-time crew tracking. (Mordor Intelligence)

The overall landscaping market size is about $190 billion in the United States and $330 billion worldwide, according to recent market reports. (Mordor Intelligence, Grand View Research)

IBISWorld counts approximately 726,565 U.S. businesses count including landscaping companies, as of 2026, a 4 % uptick over the past five years. It the proof that the biggest landscaping companies in the US coexist with a long tail of local firms.

TruGreen holds the crown among the biggest lawn care companies, while BrightView leads overall commercial landscape contracting revenue. (Modern Home Builders magazine, Landscape Management